How trading works in BC.Game

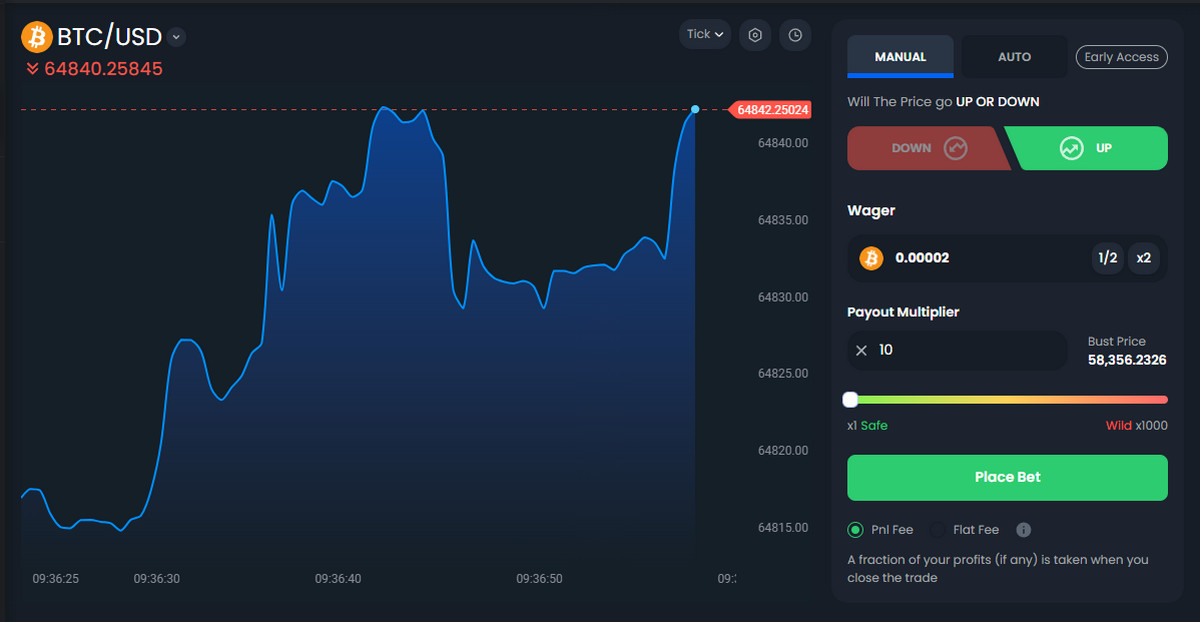

Trading on BC.Game, especially with the game “Up Down,” offers a novel and thrilling way for users to swap a variety of cryptocurrencies right on the platform. This feature not only helps in managing digital currency assets efficiently but also adds a level of excitement to the process, setting it apart from traditional trading systems.

- Access your BC.Game account. Ensure that you are logged into your BC.Game account to access the platform’s features.

- Navigate to “Up Down”. From your user dashboard, go to the trading section, specifically the area marked “Up Down.” This is where the trading activity happens, offering a unique blend of gaming and trading.

- Choose your cryptocurrencies. From your wallet, select the cryptocurrency you wish to trade and the cryptocurrency you aim to acquire. BC.Game supports a broad array of digital currencies, providing ample flexibility.

- Determine the trade amount. Input the quantity of cryptocurrency that you want to trade. Be mindful of the established minimums or maximums for transactions to ensure your trade is processed smoothly.

What cryptocurrency pairs are available in BC.Game

On the BC.Game platform, a variety of cryptocurrency pairs are available for trading and futures as described. These options reflect BC.Game’s commitment to providing diverse trading opportunities to its users, accommodating a wide array of trading strategies and preferences.

Trading pairs

These pairs allow users to trade these cryptocurrencies against the US Dollar, catering to a broad range of crypto traders interested in major and perhaps some emerging cryptocurrencies.

- BOME/USD

- BTC/USD

- ETH/USD

- DOGE/USD

- MATIC/USD

Futures pairs

The futures offerings include a mix of well-established cryptocurrencies and possibly newer or less common ones like BOME. This range enables traders to engage in speculation on the future prices of these cryptocurrencies against the US Dollar, offering opportunities for hedging and leveraging market movements.

- BTC/USD

- LTC/USD

- AVAX/USD

- BOME/USD

- DOGE/USD

- XRP/USD

- BCH/USD

- MATIC/USD

Basic trading strategy for beginners

Delve into BC.Game’s “Up Down” crypto trading game, a curious mix of fun and the dynamic world of cryptocurrency fluctuation. While differing from conventional trading paradigms, a strategic approach could intensify your foray into this interesting affair.

- Start with modest bets. Begin your trading journey with realistic, smaller bets. This strategy reduces your risk and allows you to gain experience with the platform’s nuances and strategies without wagering significant capital.

- Diversify your efforts. Apply the principle of diversification by spreading your bets across different cryptocurrencies and temporal intervals. This will minimize risk and expose you to multiple opportunities within the volatile crypto market.

- Leverage historical insights. Utilize the historical price data offered by BC.Game to gain insight into price trends and patterns. While historical performance may not reliably predict future tendencies, it can provide useful inputs on potential market behaviors.

- Stay informed. Keep abreast of major news, which can drastically influence market sentiment and impact prices, ensuring you make well-informed decisions in your trading.

- Set defined limits. Determine your maximum risk and profit objectives beforehand, then exercise the discipline required to adhere to these thresholds.

- Cultivate patience. The crypto market is inherently volatile. Maintaining patience is crucial; refrain from making rash decisions and wait for conditions to align with your strategic parameters.

- Reflect on trading outcomes. Analyze your trading history to glean insights from both successful and less successful bets. Understanding what went wrong or right will enhance your trading acumen.

- Engage with the community. While independent thinking is critical, also consider the bets and strategies of the BC.Game community for additional perspectives and deeper insights into current market trends.

Last used 6 minutes ago

Swing trading strategy

Swing trading is popular among traders as a trading strategy aiming at reaping short-to-medium term gains in stock (or any financial instrument) over a period of few days to several weeks. Swing traders will use technical analysis since the holding time of the trades is very short, but will also use fundamental analysis in making their trading decision or use both analyses to make their trading decision.

- Unification. The Swing trading will try to identify the overall trend of the market or a particular stock, then capture gains by trading within that trend. This could involve buying into a stock that’s trending upwards over several days or weeks and selling when it appears to have peaked, or short selling a stock that is in a downtrend and covering the short when it reaches a trough.

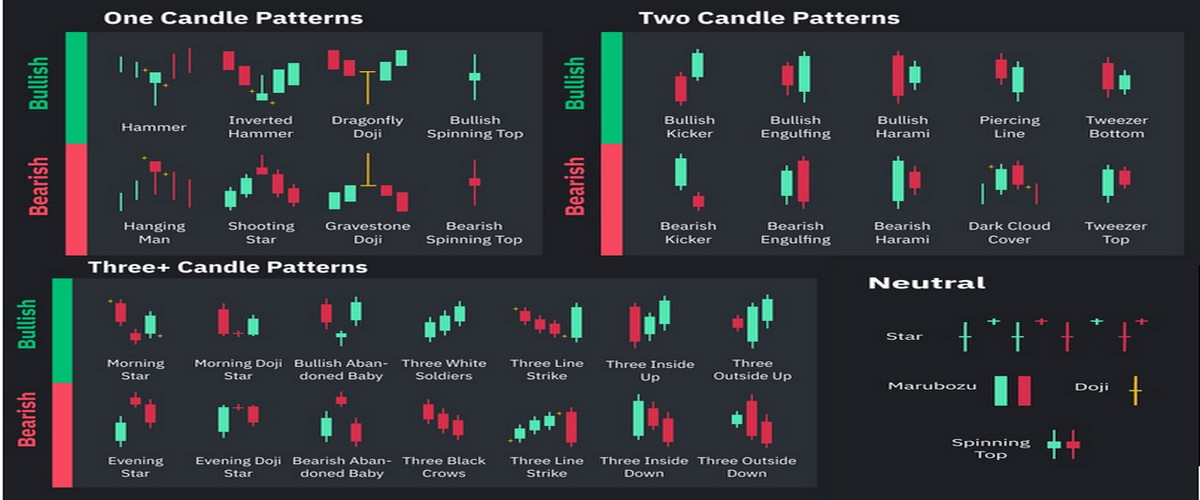

- Technical analysis. Most of the time, tools of technical analysis are preferred by the traders who adopt the form of ‘swing trading’ since they show the visual portrayal of a stock’s past and current performance—something necessary to take fast decisions. Common tools include:

- Moving Averages: These are helpful in trend direction and possible points of change in a trend.

- Relative Strength Index (RSI): Measures the speed of price changes to recognize overbought and oversold conditions.

- MACD (Moving Average Convergence Divergence): It gives the difference between two moving averages of a security’s price.

- Support and Resistance Levels: Price levels where a stock tends to stop moving and changes direction.

- Risk management. Effective risk management in this swing trading is also very important. This includes setting stop-loss orders to automatically sell a stock if it moves too far in an undesirable direction, limiting potential losses. Also, setting take-profit levels can help in locking gains before the market reverses.

- Fundamental analysis. Much less common, some swing traders will use fundamental analysis to back up their technical findings. For example, a trader might find upcoming earnings reports, product launches, or other events which would have an impact on the stock price and fall within the time span of that particular trade.

- Market sentiment. The sentiment of the market, including the way other traders and investors feel towards a stock or generally the market, can also impact swing trading decisions. Such tools that can help include news alerts, investor newsletters, and market analyst reports.

- Execution and timing timing. Given that the swing trading strategies will basically involve capturing market ‘swings,’ or cycles, timing is critical. Swing trading requires a trader to be able to act quickly upon the identification of an opportunity, which mandates that one has a good trading platform and remains constantly informed about market conditions during trading hours.

Futures

Futures, intricate financial accords, obligate the purchaser to procure or the vendor to vend a distinct financial asset at a pre-established moment and price. In the domain of cryptocurrency trading, such contracts enable speculators to prognosticate the prospective valuation of digital assets exclusive of the direct entanglement with the commodities themselves.

- Contract inception. Futures contracts come into existence when traders consent to vend or procure a specific quantity of a digital currency at an agreed-upon price to be realized on a later date. These agreements are characterized by uniformity in the volume and quality of the assets involved.

- Use of leverage. More often, trading of futures employs recourse to leverage, a peculiarity of trading where traders are enabled to participate more decisively in the market utilizing less money. This strategy can boost potential earnings while heightening the ratio of potential losses.

- Position dichotomy – long vs. short. Those anticipating an increase in the cryptocurrency’s price may take the long position, while the indication of the prices’ decrease may compel the short position.

- Settlement mechanismsю Futures contracts are settled in two principal ways – via cash settlement or via the delivery of the underlying asset. As a rule, the cryptocurrency futures market relies on cash settlement, where the difference between the contracted and present-day market prices is settled in fiat currency.

- Risk protection tools. There are multiple tools provided by the trading platforms for effective risk management, including stop-loss orders that help minimize losses. It is vital to use them prudently in order to protect the funds invested.

- Hedging and speculation. Apart from mere speculation, futures contracts also serve as a safeguard from the cryptocurrency prices’ unpredictability, bringing the illusion of stability to the traders’ funds.

Last used 6 minutes ago